For years, field service companies have been stuck choosing between two imperfect options:

- A simple accounting tool like QuickBooks, which is excellent at financials but not designed to run operations, or

- A full ERP, which promises end-to-end workflow management but often brings high implementation costs, steep learning curves, and rigid processes that don’t fit real-world service work.

Lexul changes this equation.

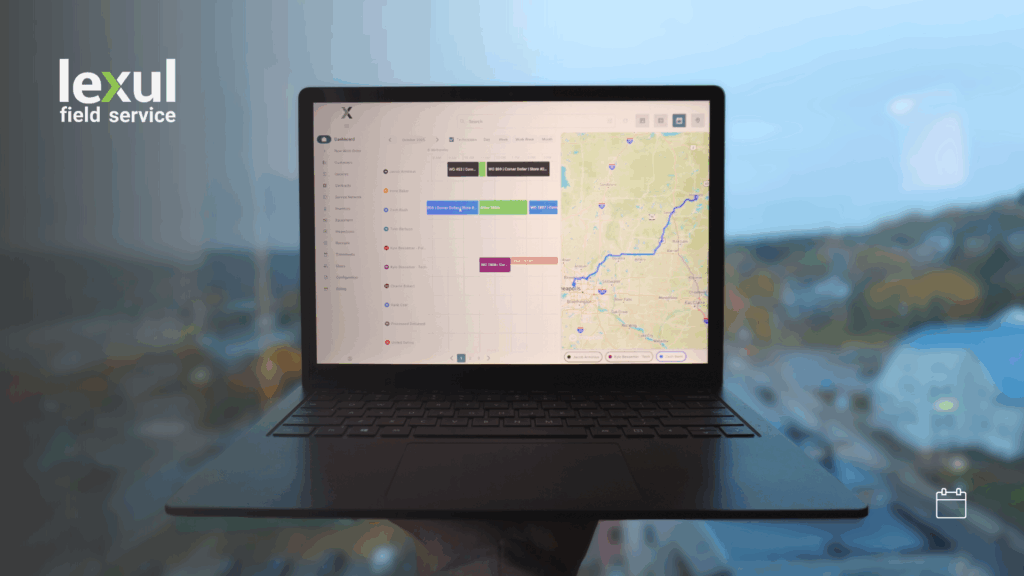

By tightly integrating with QuickBooks—both Online and Desktop/Enterprise—Lexul transforms the familiar accounting platform into a powerful, unified ERP-like solution tailored specifically for skilled trades and service-based businesses. Instead of forcing teams to adopt a massive ERP system, Lexul extends QuickBooks into an operational command center covering scheduling, dispatching, job costing, inventory, quoting, workflows, and more.

Here’s how the two systems work together to deliver true ERP-level capability.

1. A Single Source of Truth for Jobs, Customers, and Financials

Traditional ERPs consolidate operational and financial data. Lexul + QuickBooks achieve the same outcome—without forcing a migration away from the platform your finance team already knows.

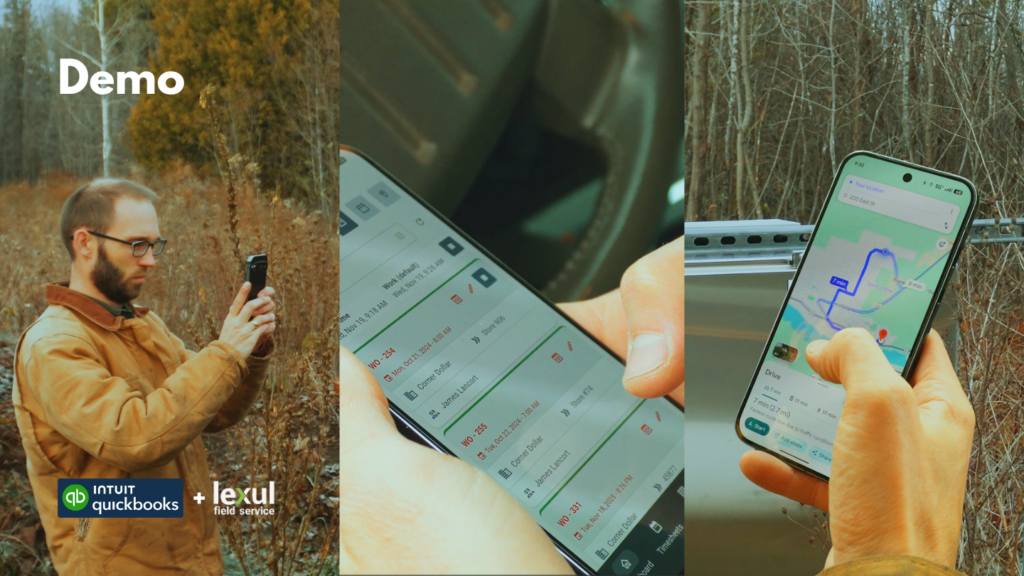

- Lexul handles job management, scheduling, dispatching, customer interactions, and inventory usage.

- QuickBooks manages chart of accounts, invoicing, payments, payroll, and reporting.

Through a real-time, two-way sync, both systems stay perfectly aligned. Job details flow from Lexul into QuickBooks for accurate billing and cost tracking. Financial updates such as paid invoices sync back into Lexul, keeping customer status up to date for your office staff.

This unified data layer eliminates double entry, eliminates version conflicts, and guarantees financial accuracy—just like a traditional ERP.

2. Full Job Lifecycle Management (the part ERPs usually handle poorly)

ERP platforms are historically built for manufacturing and distribution—not field work. Lexul fills the operational gaps by covering the entire field service workflow:

- Lead → Estimate → Job → Scheduling → Dispatch → Work Performed → Job Costing → Invoice

- Custom workflows built around the way your business actually operates

- Real-time field updates from technicians via a mobile app

These are functions ERPs often struggle to support without expensive customizations. Lexul provides them out of the box and pushes all structured job and financial data directly into QuickBooks.

3. True Job Costing With Actual vs. Estimated Performance

Most field service companies want accurate job costing but can’t achieve it with QuickBooks alone.

Lexul bridges the gap by capturing:

- Labor hours

- Materials used

- Purchase orders and vendor expenses

- Equipment usage

When that information syncs into QuickBooks, your accounting team can use native QuickBooks reporting—Profit & Loss by job, job costing center reports, and management dashboards—to understand profitability in a way that resembles ERP cost accounting.

You get the depth of ERP insights without the ERP price tag.

4. Inventory and Purchase Order Management That Feeds Accounting

QuickBooks can track inventory, but it lacks the operational workflow around it. Lexul adds:

- Multi-warehouse inventory tracking

- Truck stock management

- Real-time depletion from technician usage

- Automated or manual reordering (coming soon)

- PO approvals and receiving workflows

Once captured, all inventory movements and POs sync to QuickBooks, maintaining accurate asset and expense records. This mirrors the inventory modules of an ERP—only lighter, faster, and designed for field service rather than manufacturing.

5. Automated Billing and Collections Workflow

Lexul ensures every job reaches accounting cleanly and correctly:

- Completed jobs auto-generate invoices

- Advanced invoicing including progress and summary billing supported

- Customers can receive e-signatures, photos, notes, and attachments with their invoice

- Nearly infinitely customizable invoice templates to meet customer billing requirements

On the QuickBooks side, your accounting team continues using the familiar A/R, payment processing, and reconciliation processes they know—no ERP retraining required.

6. ERP-Level Reporting Using Native QuickBooks Financial Tools

One of the biggest advantages of keeping QuickBooks as the financial backbone is leveraging its:

- Cash flow statements

- P&L by job

- Class and location tracking

- Sales and labor reports

- Custom financial dashboards

Lexul feeds these reports with accurate, structured, real-time operational data. The combination provides visibility across operations, finances, and profitability, accomplishing what ERPs promise—without losing the simplicity of QuickBooks.

7. Lower Cost, Faster Adoption, and Easier Maintenance Than ERP Systems

ERP implementations can run:

- 6–12 months to deploy

- $100k+ in setup costs

- Extensive change management and complexity

Lexul + QuickBooks avoids all of that by:

- Sitting on top of accounting you already use

- 2-4 weeks to deploy

- $1-5k in setup costs

- Adapting to field service workflows

- Offering deep customization without custom-code ERP projects

You get 80% of traditional ERP value at ~20% of the cost and complexity.

Why Field Service Companies Are Choosing Lexul Over “Big ERP”

For growing service companies—5 to 50 technicians—Lexul + QuickBooks delivers the ideal hybrid:

- Strong operational backbone (Lexul)

- Strong financial backbone (QuickBooks)

- Real-time two-way sync that feels like a unified platform

- Job costing accuracy that rivals far more expensive systems

- Inventory, scheduling, dispatching, and workflow automation built specifically for trades

It provides ERP-level capability without forcing companies into enterprise complexity.

The Bottom Line

Lexul doesn’t replace QuickBooks—it elevates it into a full-scale operational ERP for field service businesses.

You keep the accounting platform you already know.

You gain a modern, workflow-driven system for the rest of your business.